Although touring caravan insurance isn’t a necessity — as we found out by speaking to Liz Harrison, Caravan Guard PR & Communications Manager — it’s advisable that you purchase insurance for your caravan. However, you’re probably wondering how much it’s going to cost you.

Touring caravan insurance costs roughly £90 – £500 per year. As part of our independent research, we determined the average cost of touring caravan insurance is £337.83. Factors that affect touring caravan insurance premium include the age of the tourer, where you’re storing it, and your personal circumstances such as how long you’ve been driving and your driving history.

To get a rough idea of how much touring caravan insurance is going to cost you, I decided to get quotes for several caravans of similar ages varying in value. The average cost of touring caravan insurance given above is based upon the research we conducted.

Specialist cover for folding campers and trailer tents. Caravan Guard gives you cover for storm, theft, accidental damage or vandalism under their touring caravan insurance policy. Get a quote today.

How Much Is Touring Caravan Insurance Roughly? Insurance Quote Comparison

As I mentioned earlier, in our interview with Liz Harrison of Caravan Guard, she told us that touring caravan insurance premiums can range anywhere from £90 – £500. While that gives you a really rough idea of how much you could be forking out annually, I wanted to give you a more accurate idea of how much insurance is going to cost you.

Caravan insurance costs, on average, £337.83. Factors that affect your insurance premium include the age and value of the caravan, where it is stored, and your history as a driver.

As with any kind of insurance, you will pay more if you pay monthly rather than purchasing the insurance upfront. I explained how big a difference it made in my blog post Tips For Reducing Your Caravan Insurance Premium.

So how did we determine the average touring caravan insurance premium?

To determine an average touring caravan insurance premium, I got insurance quotes for several caravans I’ve separated into three different categories:

- Low end

- Mid range

- High end

Here are the categories and the caravans within:

- Low end:

- Bailey Discovery D4-2 (2020)

- Bailey Pageant Champagne S5 (2005)

- Mid range:

- Swift Challenger 540 (2011)

- Lunar Clubman SE (2019)

- High end:

- Elddis Avante 860 (2018)

- Buccaneer Aruba (2021)

Below, I’ll give the cheapest 3 insurance premiums for each of the 6 caravans above. If you have a particular caravan in mind — for example, a mid-range tourer costing £15,000 — this should give you an even better idea of what you’re going to pay to insure it.

Specialist cover for folding campers and trailer tents. Caravan Guard gives you cover for storm, theft, accidental damage or vandalism under their touring caravan insurance policy. Get a quote today.

Average Insurance Premium For Low End Caravans

The average insurance premium for a low end caravan is £184.36.

To determine the average insurance for low end caravans, there are two caravans I got insurance quotes for:

- Bailey Discovery D4-2 (2020)

- Bailey Pageant Champagne S5 (2005)

Using an insurance comparison tool, I got touring insurance quotes for both of the caravans listed above. For the sake of this, I said the caravans would be stored in a CaSSOA Gold storage site and had no security features beyond wheel clamps. Also, the policies I choose were Market Value cover. If you weren’t aware, this is a big determiner on the insurance premium — particularly if you have an old caravan with a low market value, as New for Old cover would be substantially more expensive than the alternative in this case.

Anyway, here are the insurance quotes for both caravans (starting with the Discovery D4-2).

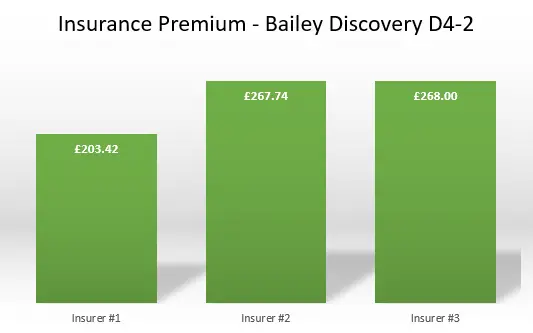

Bailey Discovery D4-2 Insurance Premium

The top 3 insurance quotes for the Bailey Discovery D4-2 (2020) were:

| Bailey Discovery D4-2 Insurer | Annual Premium |

|---|---|

| Insurer 1 | £203.42 |

| Insurer 2 | £267.74 |

| Insurer 3 | £268.00 |

As you can see, one insurer was particularly cheap. However, the average insurance premium is £246.38. This is for a relatively new, low end touring caravan.

A lot of caravanners, however, won’t purchase a brand new tourer. That’s why I decided to get quotes for an older caravan too — the Bailey Pageant Champagne S5 (2005).

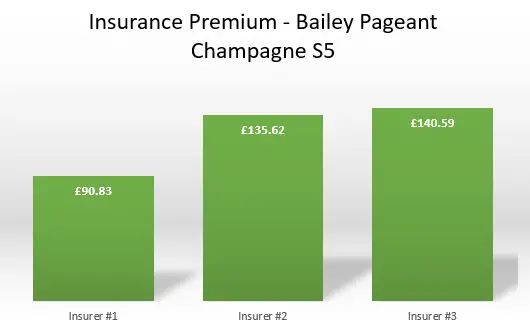

Bailey Pageant Champagne S5 Insurance Premium

The top 3 insurance quotes for the Bailey Pageant Champagne S5 were:

| Bailey Pageant Champagne S5 Insurer | Annual Premium |

|---|---|

| Insurer 1 | £90.83 |

| Insurer 2 | £135.62 |

| Insurer 3 | £140.59 |

As I explained before, the insurance premium for your caravan will vary greatly according to the market value of the caravan. That goes without saying really, but it is well reflected in the quotes we’ve gotten for the Pageant Champagne S5 and the Discovery D4-2.

The average insurance premium — based on the quotes above — is £122.34 for an older low end touring caravan.

If you’re considering a mid-range caravan — i.e., costing £12,000 – £20,000 — read on for the average insurance premium for a mid-range tourer.

Average Insurance Premium For Mid Range Caravans

The average insurance premium for a mid range caravan is £268.39.

To determine the average insurance for mid range caravans, there are two caravans I got insurance quotes for:

- Swift Challenger 540 (2011)

- Lunar Clubman SE (2019)

Using an insurance comparison tool, I got touring insurance quotes for both of the caravans listed above. For the sake of this, I said the caravans would be stored in a CaSSOA Gold storage site and had no security features beyond wheel clamps. Also, the policies I choose were Market Value cover. If you weren’t aware, this is a big determiner on the insurance premium — particularly if you have an old caravan with a low market value, as New for Old cover would be substantially more expensive than the alternative in this case.

Anyway, here are the insurance quotes for both caravans (starting with the Swift Challenger 540).

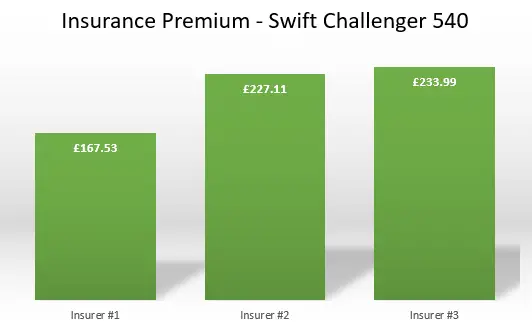

Swift Challenger 540 (2011) Insurance Premium

The top 3 insurance quotes for the Bailey Pageant Champagne S5 were:

| Swift Challenger 540 Insurer | Annual Premium |

|---|---|

| Insurer 1 | £167.53 |

| Insurer 2 | £227.11 |

| Insurer 3 | £233.99 |

The average insurance premium for an older mid range caravan is £209.54.

Purchasing a Swift Challenger 540 around the 2011 age will cost you approximately £12,500 – £13,000. Again this is Market Value cover, hence the cover is for that figure.

If you’re looking to purchase a newer mid range caravan rather than an older second hand tourer, the average insurance cost for the Lunar Clubman SE will be of more interest.

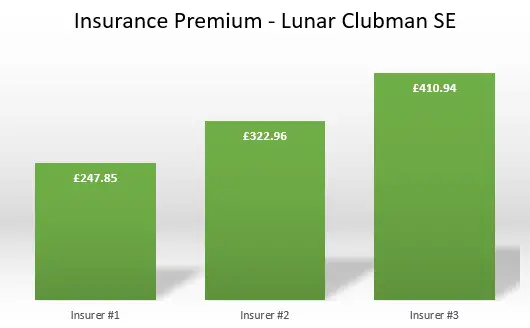

Lunar Clubman SE (2019) Insurance Premium

The top 3 insurance quotes for the Lunar Clubman SE were:

| Lunar Clubman SE Insurer | Annual Premium |

|---|---|

| Insurer 1 | £247.85 |

| Insurer 2 | £322.96 |

| Insurer 3 | £410.94 |

The average insurance cost for a newer mid range caravan is £327.25.

To give some context to this figure, the Lunar Clubman SE (2020) will cost you approximately £19,000 – £20,000. This is one of the more expensive mid range caravans available.

If you’re considering a high end caravan rather than a mid range tourer, keep reading. In the next section of this blog post, I’ll give you the average insurance premium for a high end touring caravan.

Average Insurance Premium For High End Caravans

The average insurance premium for a high end touring caravan is £560.74.

To determine the average insurance for high end caravans, there are two caravans I got insurance quotes for:

- Elddis Avante 860 (2018)

- Buccaneer Aruba (2021)

Using an insurance comparison tool, I got touring insurance quotes for both of the caravans listed above. For the sake of this, I said the caravans would be stored in a CaSSOA Gold storage site and had no security features beyond wheel clamps. Also, the policies I choose were Market Value cover. If you weren’t aware, this is a big determiner on the insurance premium — particularly if you have an old caravan with a low market value, as New for Old cover would be substantially more expensive than the alternative in this case.

Anyway, here are the insurance quotes for both caravans (starting with the Elddis Avante 860).

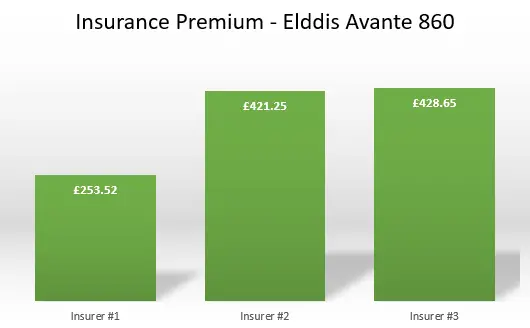

Elddis Avante 860 (2018) Insurance Premium

The top 3 insurance quotes for the Elddis Avante 860 were:

| Elddis Avante 860 Insurer | Annual Premium |

|---|---|

| Insurer 1 | £253.52 |

| Insurer 2 | £421.25 |

| Insurer 3 | £428.65 |

The average insurance cost for an older used high end caravan is £367.80.

To give some context to the quote — considering this is for Market Value cover — you can pick up an Elddis Avante 860 for approximately £21,000 – £22,000. Of course, that all depends on condition and where you’re looking to purchase a caravan.

If you’re wanting to go for a high-spec brand new tourer, keep reading.

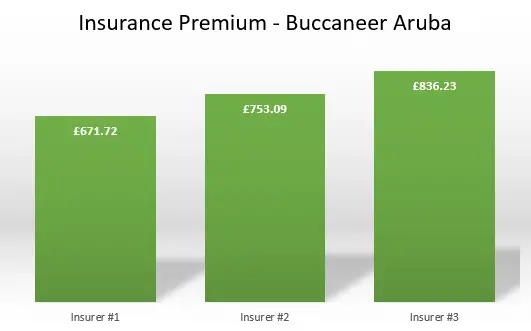

Buccaneer Aruba (2021) Insurance Premium

The top 3 insurance quotes for the Buccaneer Aruba were:

| Elddis Avante 860 Insurer | Annual Premium |

|---|---|

| Insurer 1 | £671.72 |

| Insurer 2 | £753.09 |

| Insurer 3 | £836.23 |

The average cost for a new high end tourer — costing within the £30,000 – £35,000 range — is £753.68.

To give some context, the Buccaneer Aruba is about as high end as you get where touring caravans are concerned. This is a luxurious 6 berth caravan with one of the finest specs you’ve ever seen. Brand new, an Aruba will set you back £35,000 – £36,000.

You’ll need deep pockets if you’re wanting to insure a high-end touring caravan. But then you must have had deep pockets to buy one in the first place!

Specialist cover for folding campers and trailer tents. Caravan Guard gives you cover for storm, theft, accidental damage or vandalism under their touring caravan insurance policy. Get a quote today.